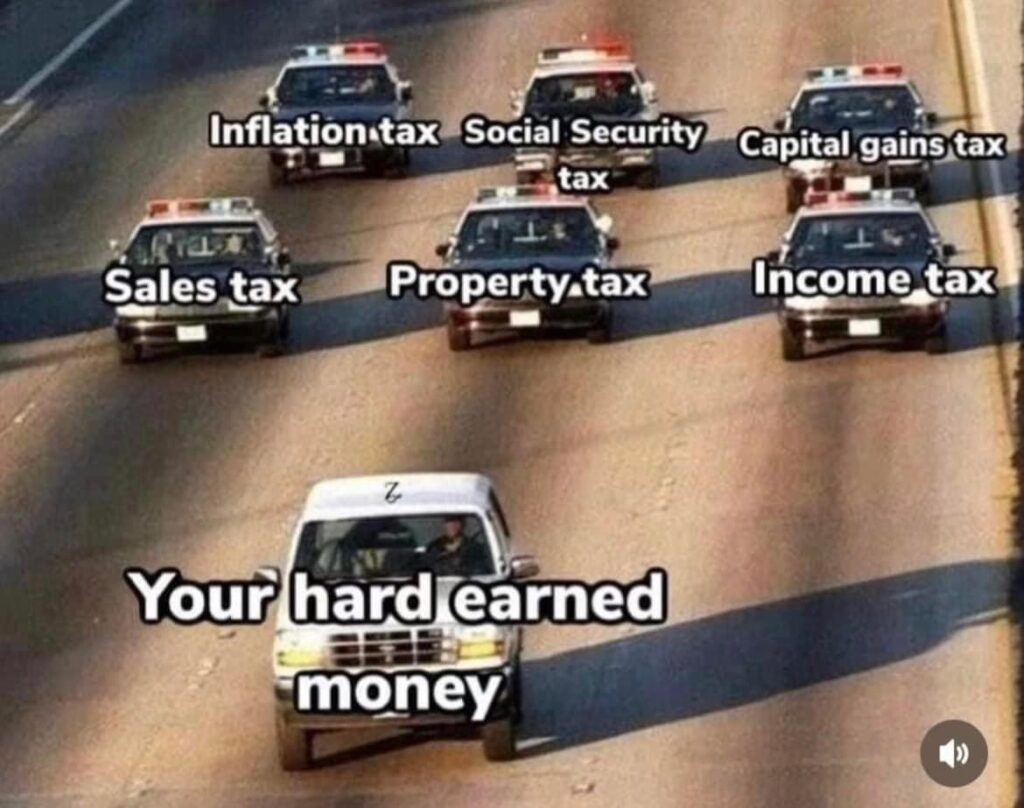

Hello, fellow financial navigators! If you’ve ever felt like your hard-earned money is on a constant chase, pursued by a never-ending array of taxes and fees, you’re not alone. From property taxes to income taxes, sales tax to license fees, and the many other deductions, it often feels like a financial maze. Let’s delve into this complex landscape and understand how to maneuver through it with savvy.

Property Taxes: The Annual Visitor

Picture this: your mailbox receives an annual guest in the form of a property tax bill. While they support local services, property taxes can sometimes feel like an uninvited guest overstaying their welcome. But fret not – understanding how these taxes are calculated and allocated can make dealing with them a bit less daunting.

Income Taxes: The Regular Deduction Dance

Ah, income taxes – the dance you can’t avoid. It’s that time of year when you carefully assemble your documents and perform the annual tax deduction tango. Knowing the ins and outs of tax credits, deductions, and the latest changes in tax laws can help you optimize your returns and prevent Uncle Sam from dancing away with more than his fair share.

Sales Tax: The Sneaky Contributor

Every time you make a purchase, a sneaky participant steps in – sales tax. Often overlooked, these small percentages accumulate over time. Understanding how sales tax applies in different states, and even within localities, can help you plan your spending more effectively.

License Fees: The Hidden Costs

Your car may be your ticket to freedom, but it comes with license fees. Vehicle registration, emissions tests, and more – these costs can add up. Learning about the various fees associated with owning and maintaining your vehicle can prevent you from feeling like you’re paying for a backstage pass to the highway.

Social Security Tax: The Future Investment

We’ve all seen it on our pay stubs – the contribution to Social Security. While it may feel like a deduction, it’s actually an investment in your future. Understanding how Social Security works and its long-term benefits can put your mind at ease when you see those deductions.

Navigating the Financial Labyrinth

Ladies and gentlemen, our hard-earned money often seems like it’s navigating a labyrinth of taxes and fees. However, armed with knowledge and a strategic approach, we can navigate this maze more efficiently. Research, financial planning, and staying informed about tax laws and changes can help us keep more of our earnings and make better financial decisions. Remember, while taxes and fees may be a constant, your financial wisdom can help you make the most out of your hard-earned money.

As an Amazon Associate we earn from qualifying purchases through some links in our articles.